LCERPA

Top Stories

Laurier Centre for Economic Research and Policy Analysis

Top Stories

Top Stories

Featured Pedro Antunes, Chief Economist, Conference Board of Canada & Jennifer Hunt, Professor of Economics, Rutgers University and former Chief Economist, U.S. Secretary of Labor on Wednesday, February 12, 2025.

READ MORE

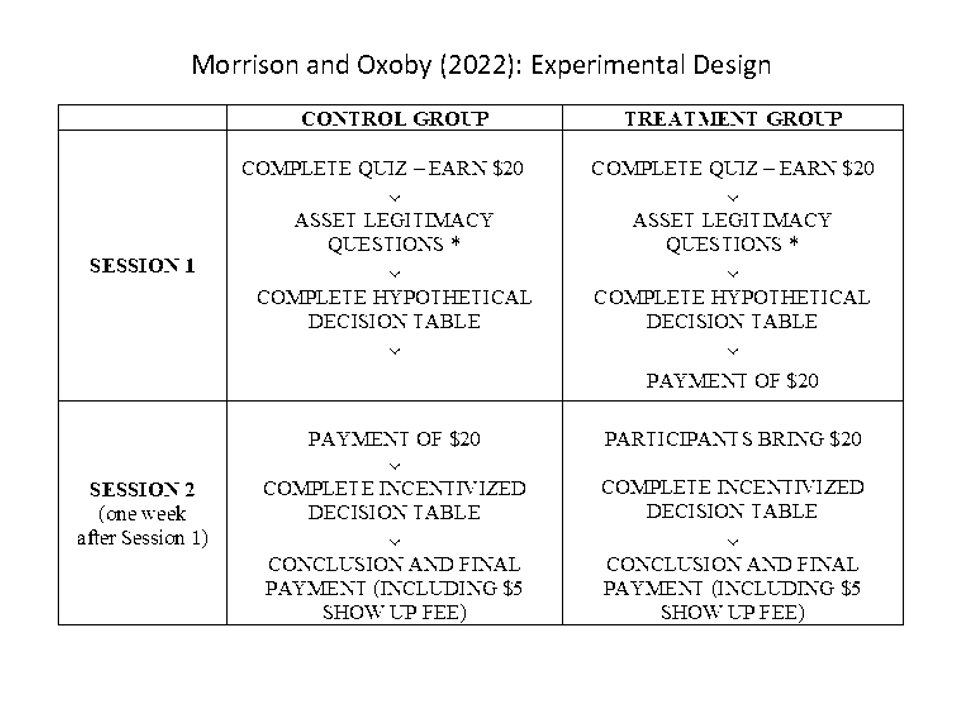

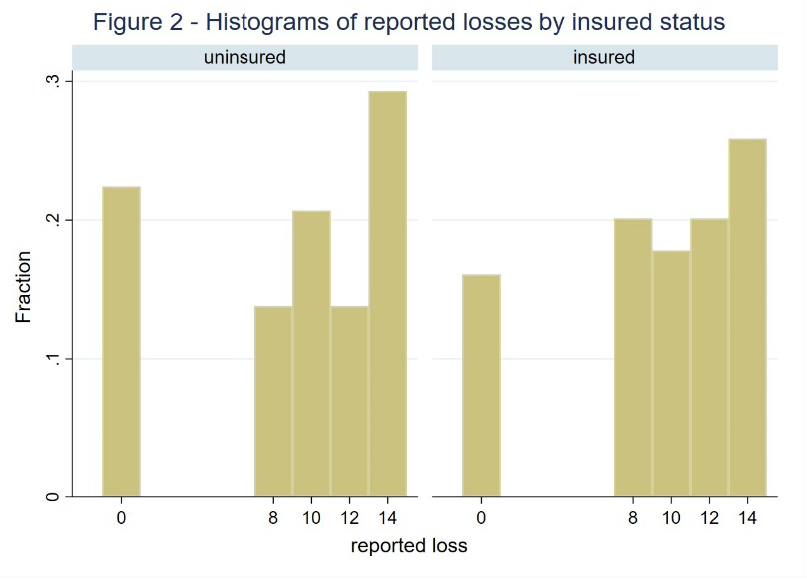

In a paper accepted by the Journal of Risk and insurance, Laurier professor William Morrison and co-author Bradley Ruffle conduct a lab experiment on insurance claims and find that there is no link between dishonest insurance reporting and the amount paid for insurance. Similarly, decreases in the consumer surplus from insurance purchases do not induce more dishonest reporting.

aaaaaaaa

READ MORE

LCERPA congratulates our four members who have recently been announced as recipients of SSHRC Insight Development Grants.

aaaaaaaa

READ MORE

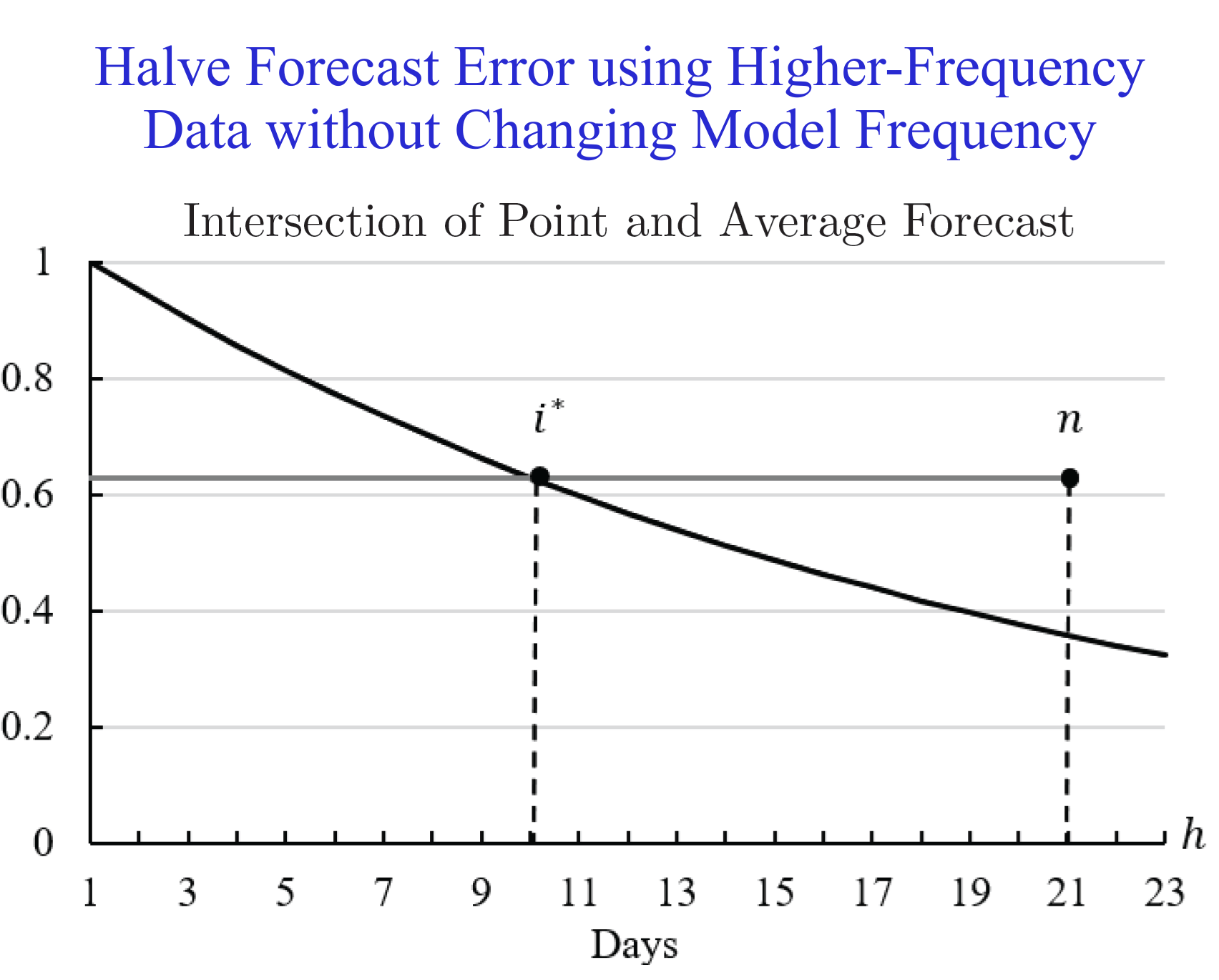

New working paper by

Dr. Stephen Snudden

and co-authors analyses the Forecasts of Temporally Aggregated Data.

READ MORE

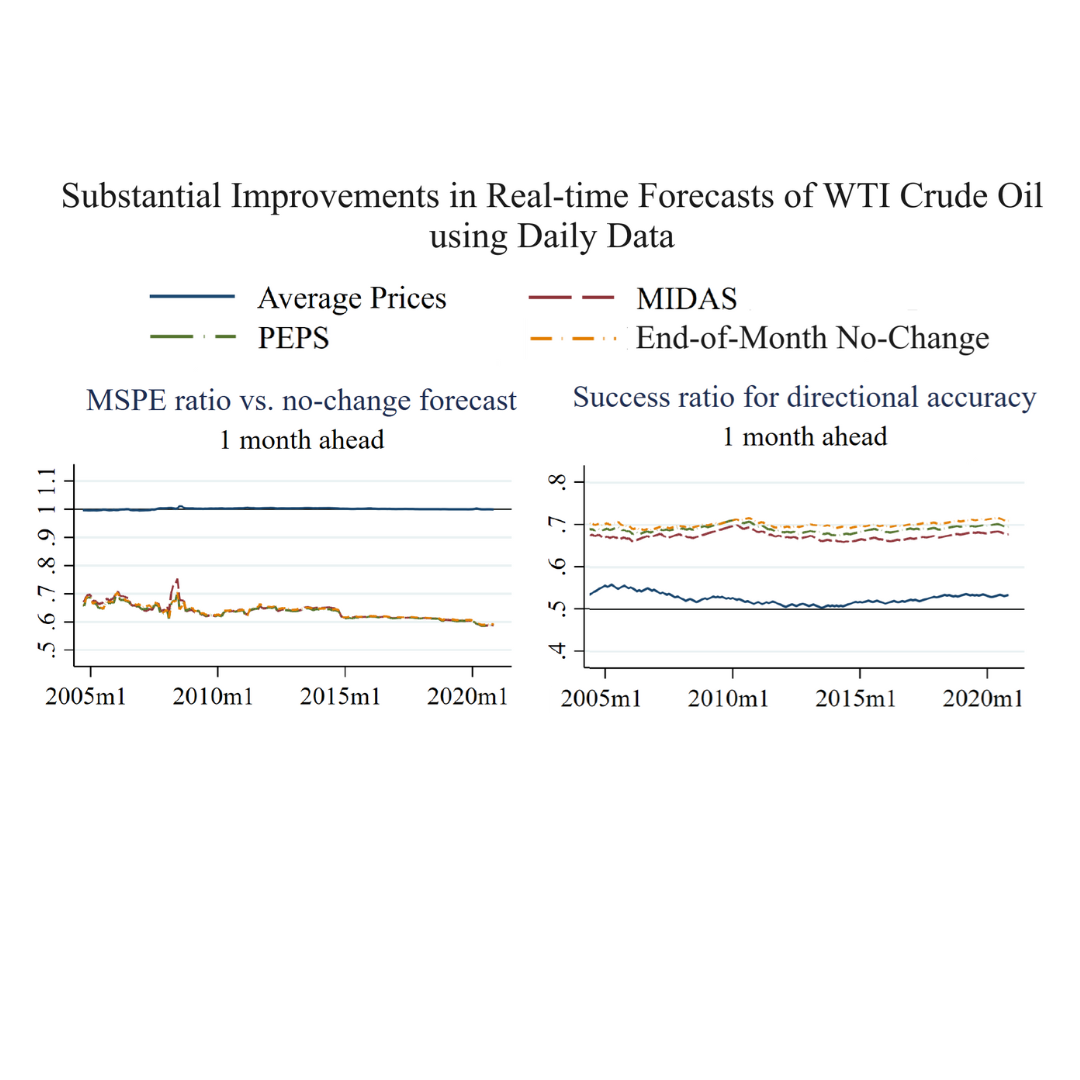

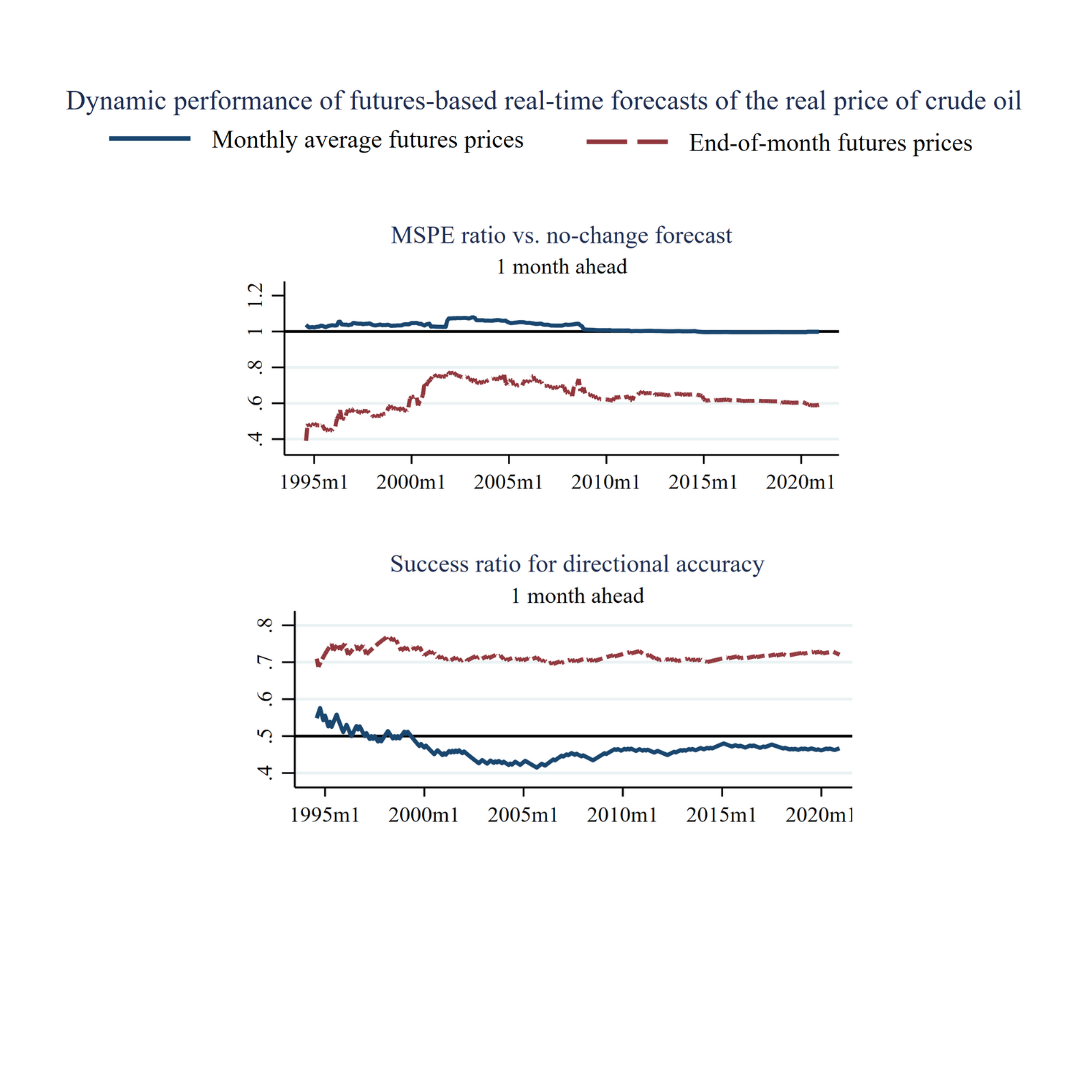

New working paper by

Dr. Stephen Snudden

and co-authors analyzes whether daily oil prices improve model-based forecasts of the real price of crude oil.

READ MORE

New working paper by

Dr. Antonella Mancino

and co-author Dr. Cecilia S. Diaz Campo highlights the underlying mechnisms of opioid elasticities.

READ MORE

Congratulations to

Dr. Ke Pang

and

Dr. Christos Shiamptanis

on their published paper in the Journal of International Money & Finance.

READ MORE

Congratulations to

Dr. Stephen Snudden

and co-authors on their published paper in the Journal of Banking & Finance.

READ MORE

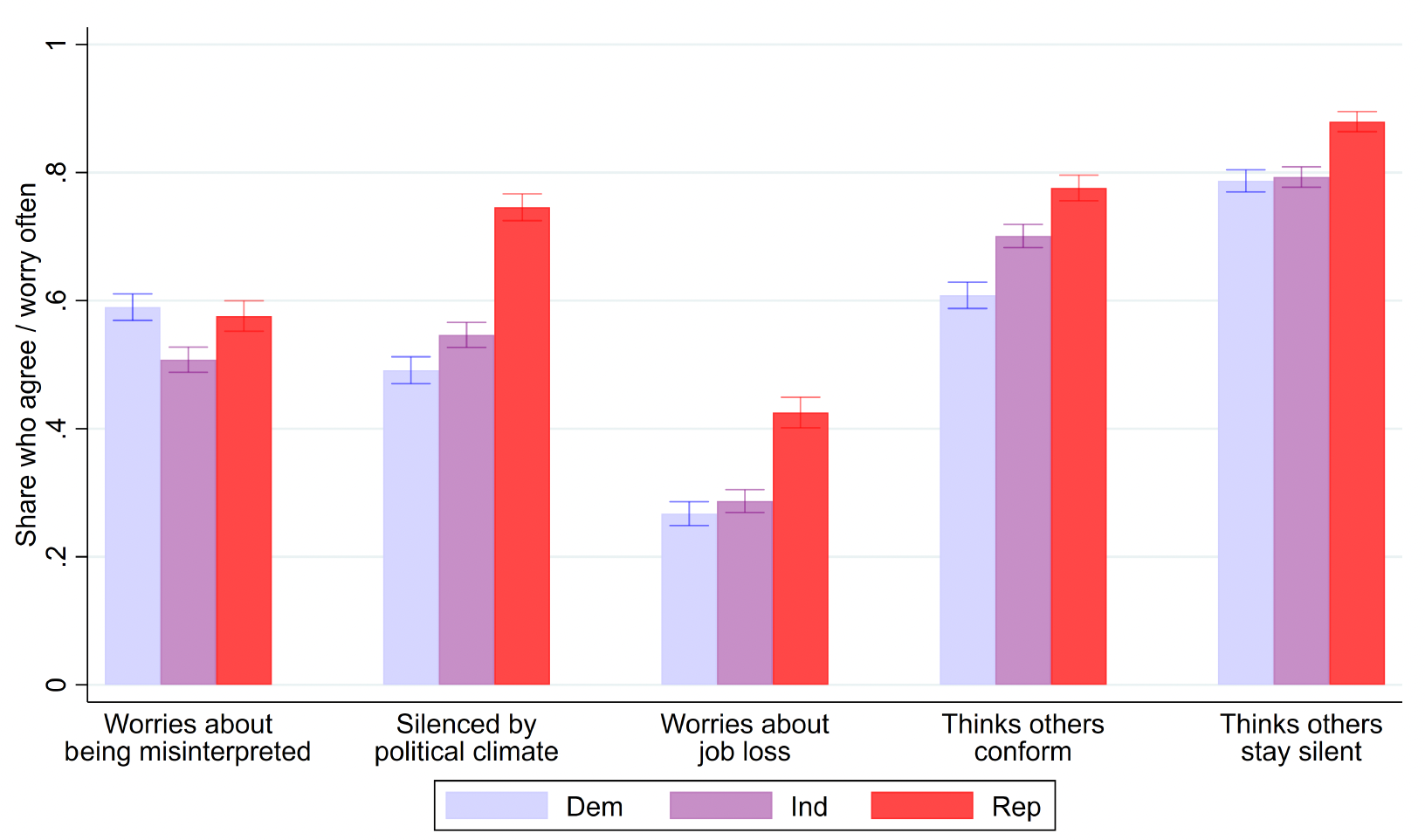

New working paper by

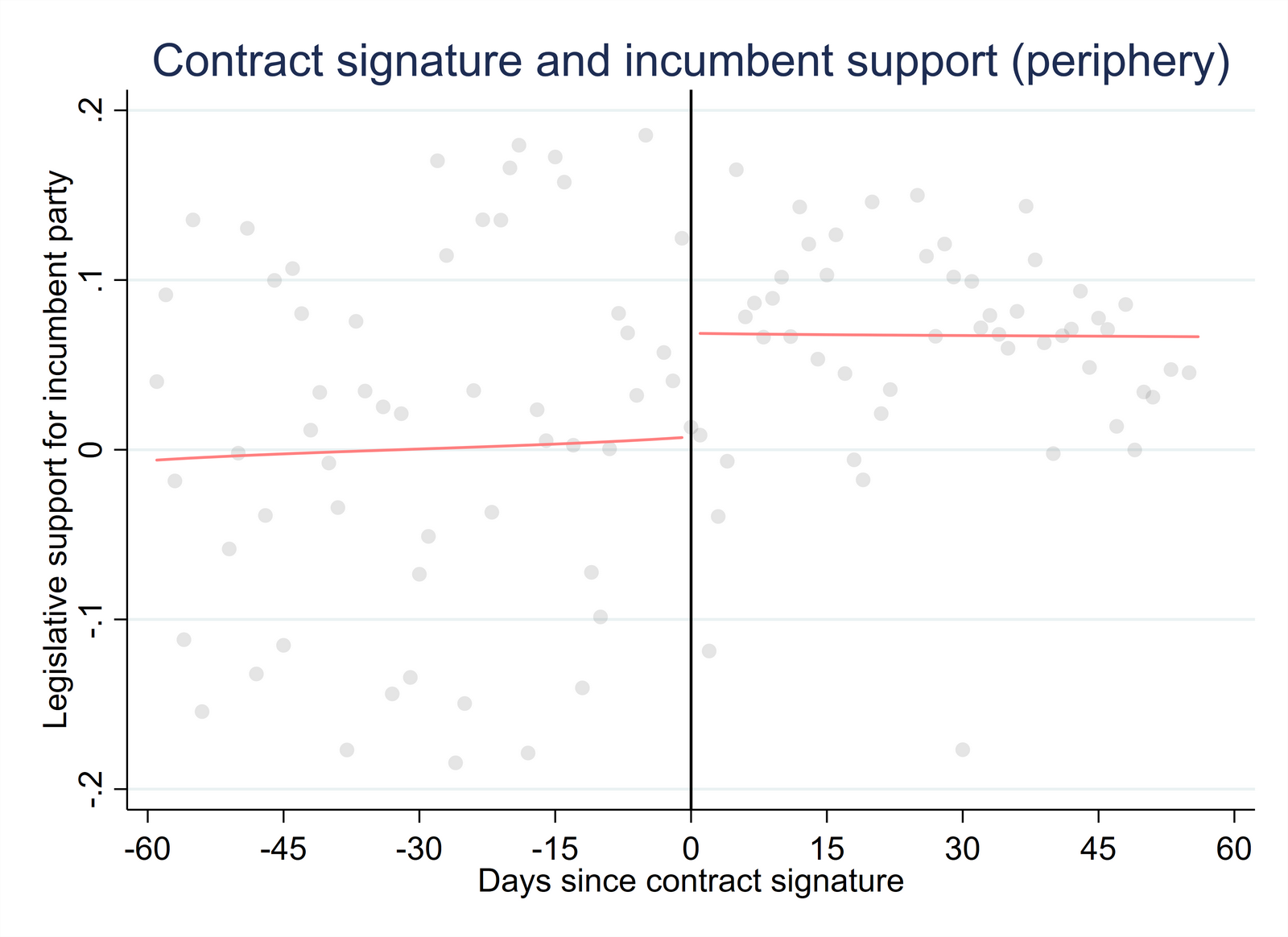

Dr. Juan S. Morales

and co-authors analyzes the effect of social pressure on free speech.

READ MORE

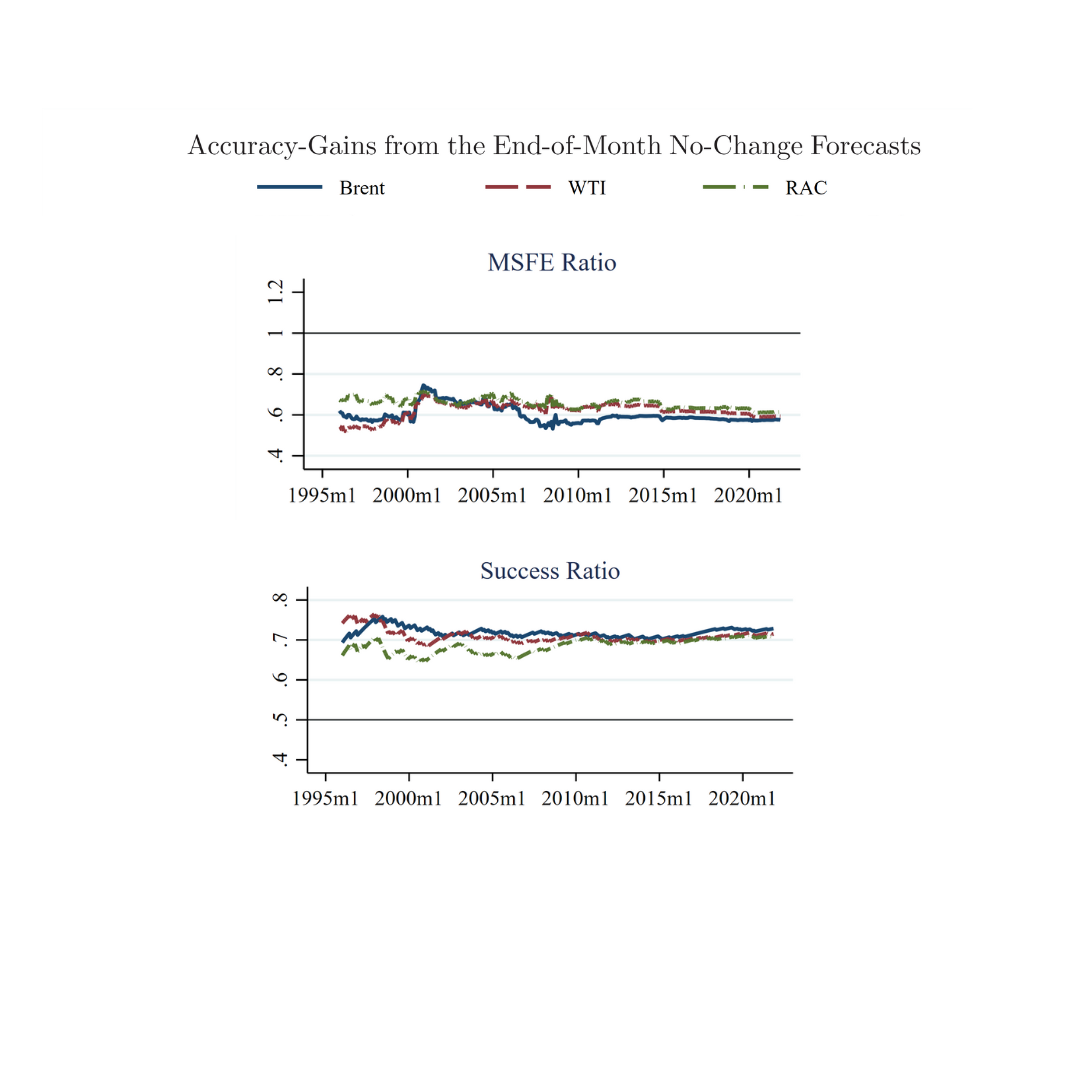

Congratulations to

Dr. Stephen Snudden

and co-authors on their published paper in The Energy Journal.

READ MORE

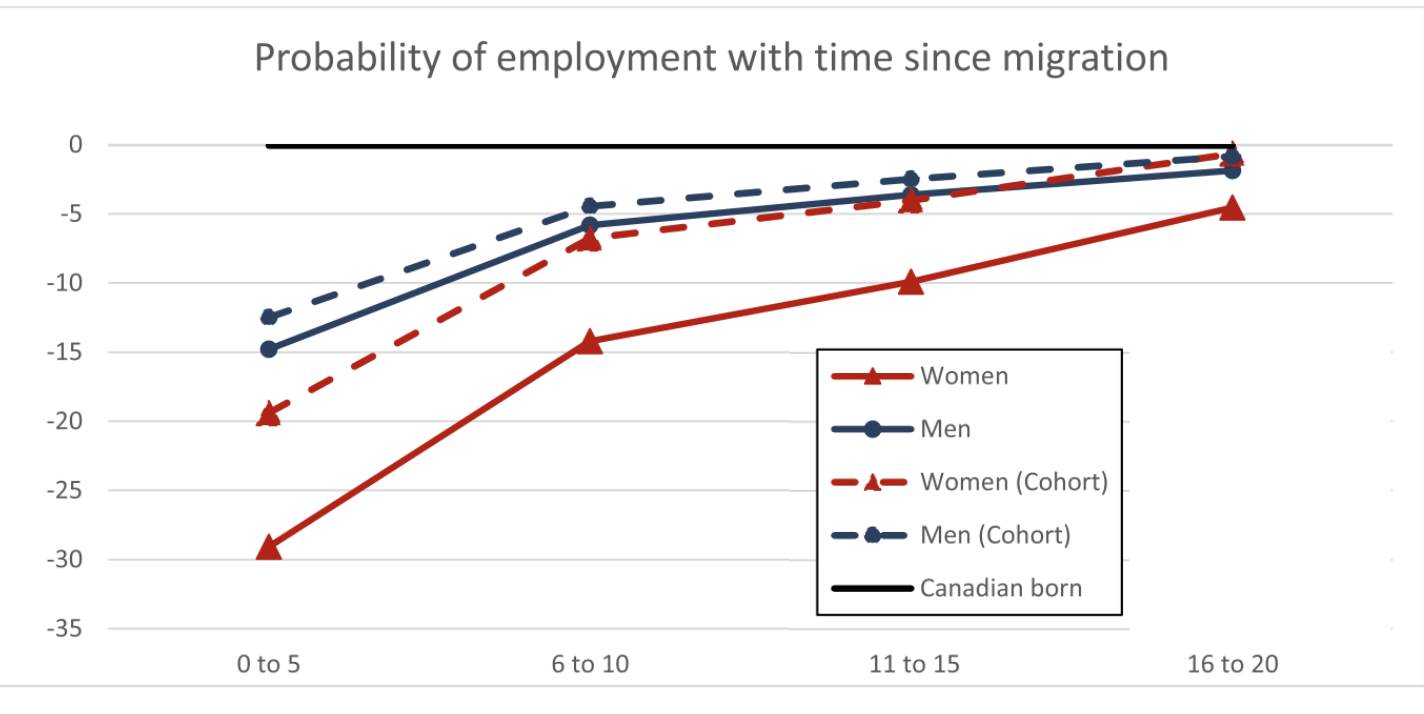

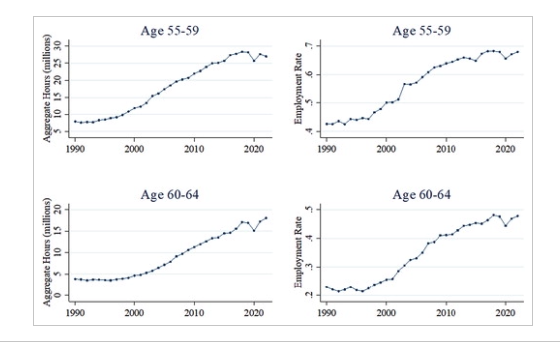

Congratulations to

Dr. Tammy Schirle

and co-authors on their published paper in the Canadian Public Policy.

READ MORE

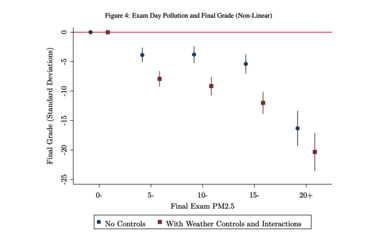

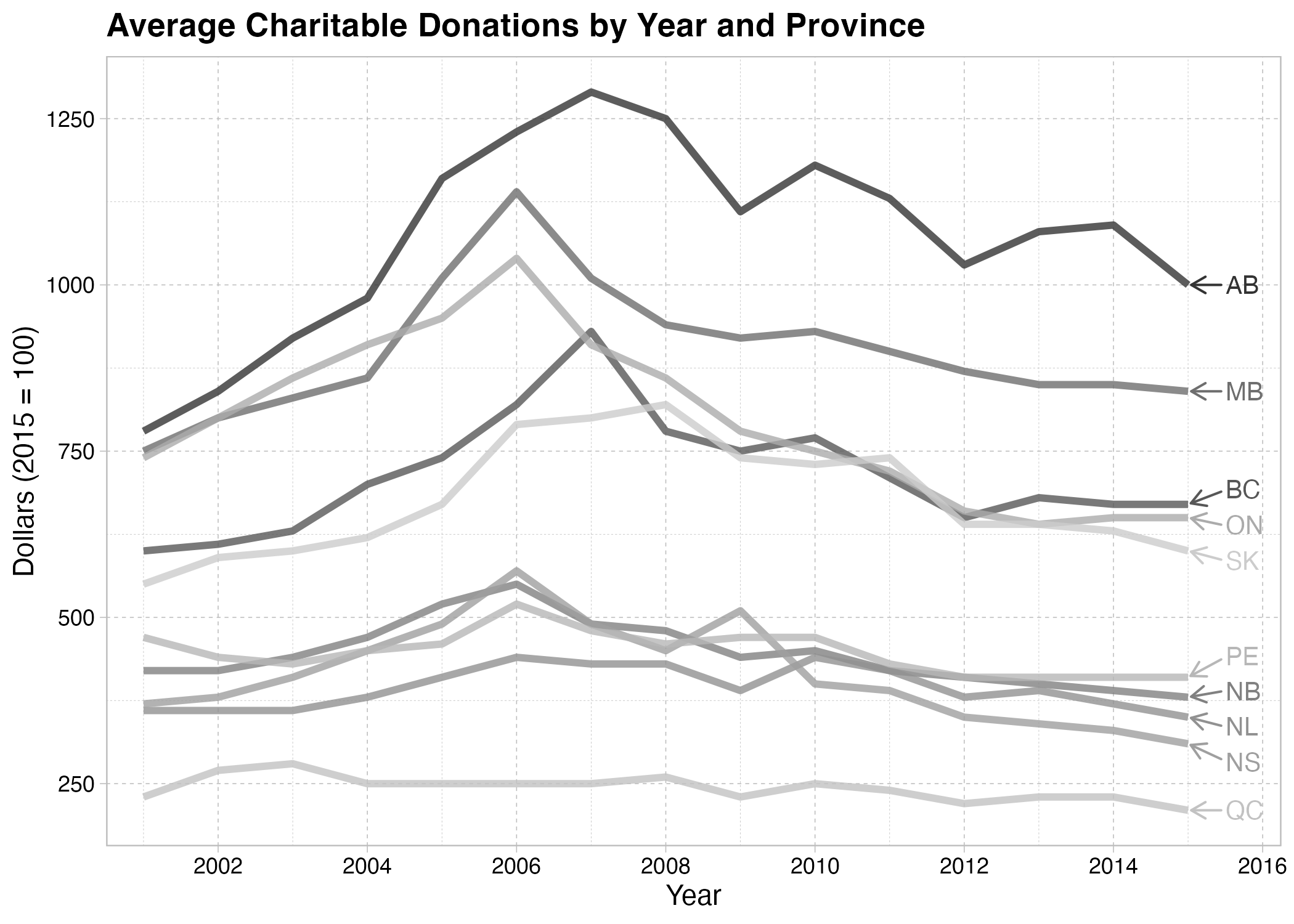

Congratulations to

Dr. Justin Smith

and co-authors on their published article in the National Tax Journal.

READ MORE

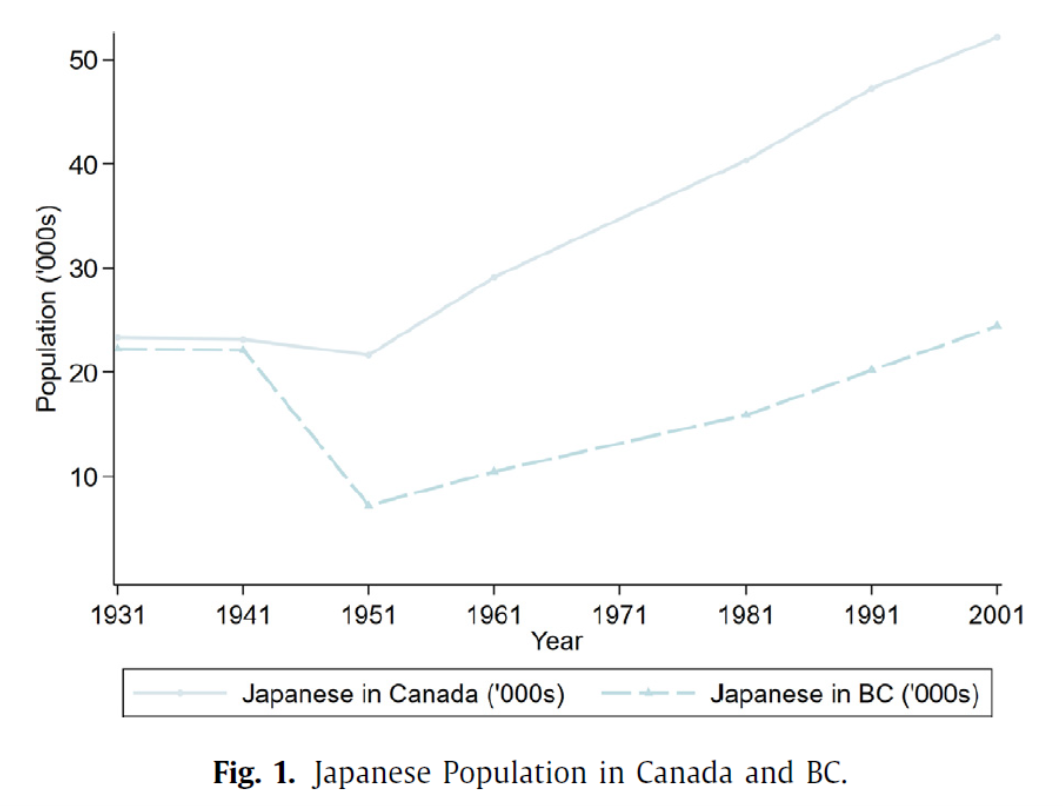

Congratulations to

Dr. Jeff Chan

on his published paper in the Journal of Economic Behavior & Organization.

READ MORE

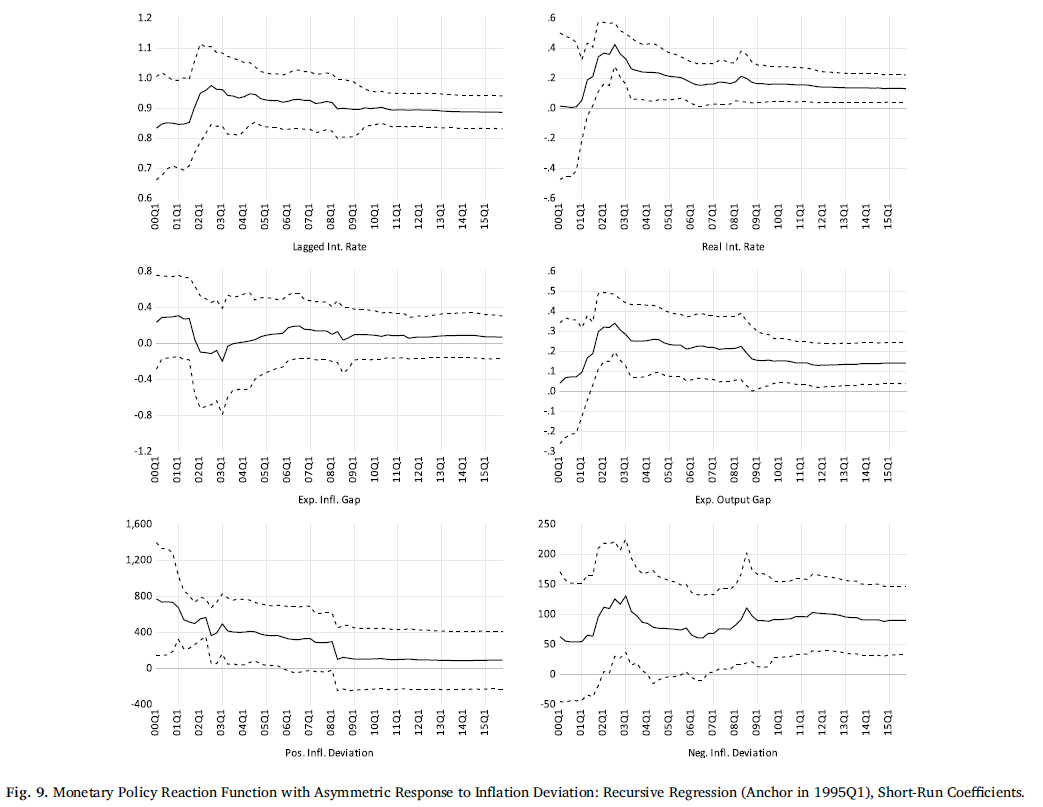

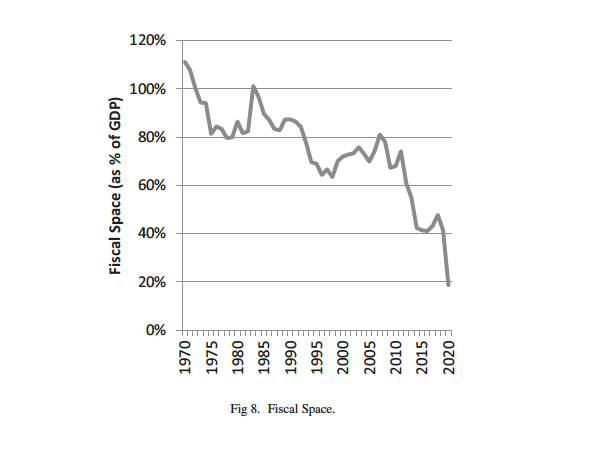

Congratulations to

Dr. Christos Shiamptanis

on his published paper in the Journal of Money, Credit, and Banking.

READ MORE

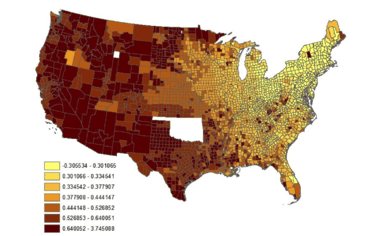

Congratulations to

Dr. David Rose

and coauthors and on their accepted paper in The Quarterly Journal of Economics. aaaaaaaaaaaaaaaaaaaaa

aaaaaaaaaaaaaaa

aaaaaaaaaaaaaaaa

READ MORE